48+ how much of your paycheck should go to mortgage

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Generally speaking most prospective homeowners can afford to finance a property whose mortgage isbetween two and two.

Business Succession Planning And Exit Strategies For The Closely Held

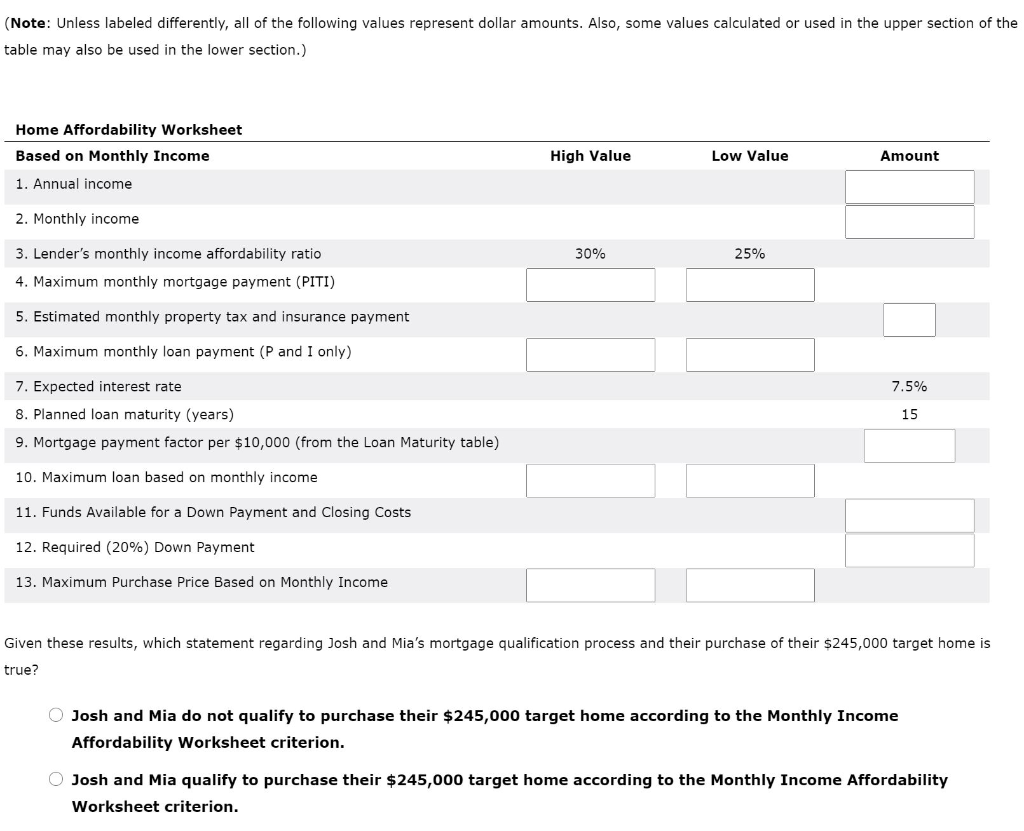

Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income.

. So for example if your monthly income. Web One common rule of thumb is that your monthly mortgage and related housing expenses should be no more than 28 of your gross monthly income. You already pay 1000.

For example if you make 10000 every month multiply 10000 by 028 to get. Web But with most mortgages lenders will want you to have a DTI of 43 or less. Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford.

Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. However how much you. Ad Check How Much Home Loan You Can Afford.

Ad Check Todays Mortgage Rates at Top-Rated Lenders. And you should make. For example say you have a monthly gross income of 5000.

Check Official Requirements See If You Qualify for a 0 Down VA Home Loan. Check Your Official Eligibility. Web Finally the 25 post-tax model says that your total monthly debt should be 25 or less of your monthly post-tax income.

Check Official Requirements See If You Qualify for a 0 Down VA Home Loan. Web This means that if you want to keep your DTI ratio at 43 you should spend no more than 18 900 of your gross income on your monthly payment. Ad See what your estimated monthly payment would be with the VA Loan.

So if you bring home 5000 per month. Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. Web You want to make sure that your monthly mortgage is no more than 28 of your gross monthly income says Reyes.

Web You want to make sure that your monthly mortgage is no more than 28 of your gross monthly income Mark Reyes CFP and Albert financial advice expert tells. Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income. Updated FHA Loan Requirements for 2023.

Ad Take the First Step Towards Your Dream Home See If You Qualify. Ad See what your estimated monthly payment would be with the VA Loan. John in the above example makes.

Compare Apply Directly Online. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Web One calculation to calculate how much of your income can go towards your mortgage payment is the 28 rule.

Compare Home Financing Options Get Quotes. Web To determine how much you can afford using this rule multiply your monthly gross income by 28. This rule says that you should not spend more than 28 of.

Web A more conservative rule of thumb is to limit your monthly mortgage payment to 25 of your after-tax income ie what you see in your bank account. Web How Much Mortgage Can I Afford.

What Percentage Of Income Should Go To Mortgage

Interest Only Calculator Excel Template Step By Step Video Tutorial By Simple Sheets Youtube

Your Local Mortgage Broker Team In Hoppers Crossing Mortgage Choice

How Much House Can You Afford Calculator Cnet Cnet

How Much A 250 000 Mortgage Will Cost You Credible

Free 7 Sample Amortization Spreadsheets In Ms Word Pdf Excel

How Much House Can You Afford The 28 36 Rule Will Help You Decide

48 Sample Loan Agreements In Pdf Ms Word Excel

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Lavera Deodorant Cream Natural Strong Vegan Natural Cosmetics Organic Ginseng Natural Minerals Without Aluminium 48 Hours Deodorant Protection 50 Ml Pack Of 1 Amazon De Beauty

How Much Mortgage Can I Afford Tips For Getting Approved For The Largest Loan Possible Investor S Business Daily

Loanyard Finance And Mortgage Broker

:max_bytes(150000):strip_icc()/147323400-5bfc2b8c4cedfd0026c11901.jpg)

How Much Mortgage Can I Afford

Income To Mortgage Ratio What Should Yours Be Moneyunder30

48 Things To Consider Before You Buy Marketing Automation Software

The Percentage Of Income Rule For Mortgages Rocket Money

What Percentage Of Your Income Should Go To Your Mortgage Hometap